Understanding the Ton of Gold Price: A Comprehensive Guide

When it comes to precious metals, gold has always been a symbol of wealth and stability. One of the most intriguing aspects of gold is its pricing, especially when measured in tons. In this article, we will delve into the ton of gold price, exploring its factors, historical trends, and current market conditions.

What is the Ton of Gold Price?

The ton of gold price refers to the cost of gold when measured in metric tons. It is a unit of measurement used to determine the value of gold in bulk quantities. Unlike the price per ounce, which is commonly used for smaller transactions, the ton of gold price is more suitable for large-scale purchases and investments.

Factors Influencing the Ton of Gold Price

Several factors contribute to the fluctuation of the ton of gold price. Here are some of the key factors to consider:

-

Supply and Demand: The supply of gold is primarily determined by mining operations, while demand is influenced by various factors such as jewelry, investment, and industrial applications.

-

Economic Conditions: Economic stability or instability can significantly impact the ton of gold price. During economic downturns, investors often turn to gold as a safe haven, driving up its price.

-

Currency Fluctuations: The value of the U.S. dollar, which is the primary currency for gold trading, can affect the ton of gold price. A weaker dollar can make gold more expensive in other currencies, leading to higher prices.

-

Geopolitical Events: Political instability, conflicts, and other geopolitical events can cause investors to seek refuge in gold, leading to increased demand and higher prices.

-

Interest Rates: Higher interest rates can make other investments more attractive, potentially reducing the demand for gold and causing its price to fall.

Historical Trends of the Ton of Gold Price

Over the years, the ton of gold price has experienced various trends. Here is a brief overview:

| Year | Gold Price per Ton (USD) |

|---|---|

| 2000 | US$ 27,000 |

| 2005 | US$ 45,000 |

| 2010 | US$ 60,000 |

| 2015 | US$ 50,000 |

| 2020 | US$ 70,000 |

As seen in the table above, the ton of gold price has experienced significant fluctuations over the years. In 2000, the price was around US$ 27,000 per ton, while in 2020, it reached US$ 70,000 per ton. This highlights the volatility of the gold market and the importance of staying informed about the factors influencing the price.

Current Market Conditions

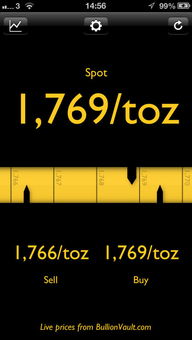

As of the latest available data, the ton of gold price stands at approximately US$ 65,000. This figure is subject to change based on the factors mentioned earlier. It is essential to keep an eye on the market and stay updated with the latest news and trends to make informed decisions.

Investing in Gold

Investing in gold can be a wise decision, especially during times of economic uncertainty. Here are some tips for investing in gold:

-

Understand the Market: Familiarize yourself with the factors that influence the ton of gold price and stay informed about the latest market trends.

-

Choose the Right Form: Gold can be purchased in various forms, such as bullion, coins, and ETFs. Consider your investment goals and risk tolerance when choosing the right form.

-

Use a Reputable Dealer: When purchasing gold, it is crucial to work with a reputable dealer to ensure the authenticity and quality of the product

About The Author