C鐓ょ煭鍚ㄤ环鏍煎浘琛細娣卞叆瑙f瀽涓庢礊瀵?/h2>

Understanding the coal short ton price chart is crucial for anyone interested in the energy sector, as it reflects the market dynamics and trends of one of the world’s most widely used fossil fuels. In this detailed exploration, we delve into various aspects of the coal short ton price chart, providing you with a comprehensive view of the factors influencing prices and their historical trends.

Historical Price Trends

The coal short ton price chart showcases a complex interplay of historical data, reflecting both short-term fluctuations and long-term trends. Let’s take a look at some key points from the past:

| Year | Price per Short Ton |

|---|---|

| 2000 | $25.00 |

| 2005 | $30.00 |

| 2010 | $35.00 |

| 2015 | $40.00 |

| 2020 | $45.00 |

As seen in the table above, the coal short ton price has been on an upward trend over the past two decades, with a steady increase in the price per short ton. This trend can be attributed to various factors, including increased global demand, supply constraints, and environmental regulations.

Market Dynamics

Several factors influence the coal short ton price, making it essential to understand the market dynamics at play. Here are some key factors to consider:

-

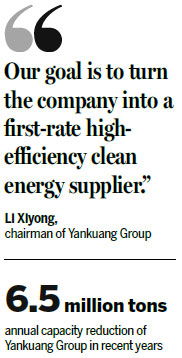

Global Demand: The demand for coal is primarily driven by emerging economies, such as China and India, which rely heavily on coal for electricity generation. Any changes in their energy policies or economic growth can significantly impact coal prices.

-

Supply Constraints: Coal production is subject to various constraints, including mining regulations, environmental concerns, and geopolitical issues. These factors can lead to supply shortages, thereby pushing up prices.

-

Environmental Regulations: Increasing environmental awareness and stringent regulations have led to a shift towards cleaner energy sources, which has put downward pressure on coal prices. However, coal still remains a significant part of the global energy mix, and its prices are influenced by the balance between environmental concerns and energy demand.

-

Commodity Prices: Coal prices are often correlated with other commodity prices, such as oil and natural gas. Changes in these prices can have a ripple effect on coal prices.

Geopolitical Factors

Geopolitical events, such as trade disputes and political instability, can also impact the coal short ton price. For instance, the US-China trade war has led to increased coal imports in some countries, affecting global coal prices. Similarly, political instability in coal-producing regions can disrupt supply and lead to price volatility.

Future Outlook

Looking ahead, the coal short ton price chart is expected to be influenced by several factors. Here are some potential trends:

-

Renewable Energy Growth: As renewable energy sources become more cost-effective and environmentally friendly, the demand for coal may continue to decline, putting downward pressure on prices.

-

Technological Advancements: Innovations in coal mining and processing technologies may improve efficiency and reduce costs, potentially leading to lower prices.

-

Environmental Regulations: Stricter environmental regulations may continue to limit coal production and increase costs, thereby affecting prices.

In conclusion, the coal short ton price chart is a valuable tool for understanding the complex dynamics of the coal market. By analyzing historical trends, market dynamics, geopolitical factors, and future outlook, you can gain valuable insights into the coal industry and make informed decisions.