Sulphur Price Chart Per Ton: A Comprehensive Guide

When it comes to the global market for Sulphur, understanding the price chart per ton is crucial for businesses and investors alike. Sulphur, often referred to as the “yellow gold,” is a vital commodity used in various industries, including fertilizers, chemicals, and energy production. In this detailed guide, we will explore the factors influencing Sulphur prices, historical trends, and future projections.

Market Dynamics

The Sulphur market is influenced by several key factors, including supply and demand, geopolitical events, and production costs. Let’s delve into each of these aspects to gain a better understanding of the Sulphur price chart per ton.

| Factor | Description |

|---|---|

| Supply | Supply is primarily driven by the extraction of Sulphur from natural gas processing plants and volcanic activity. Major producers include the United States, China, and Russia. |

| Demand | Demand for Sulphur is influenced by the growth of the fertilizers and chemicals industries. Countries with high agricultural output, such as India and China, are significant consumers. |

| Geopolitical Events | Geopolitical tensions and trade disputes can impact Sulphur prices, as they may affect the availability of the commodity and transportation routes. |

| Production Costs | Production costs, including extraction, transportation, and refining, play a crucial role in determining the price of Sulphur. |

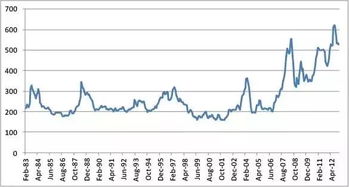

Historical Price Trends

Over the past few decades, the price of Sulphur has experienced significant fluctuations. Let’s take a look at some key historical price trends.

From the early 2000s to 2010, the price of Sulphur remained relatively stable, hovering around $200 per ton. However, in 2010, the price experienced a sharp increase, reaching a peak of $400 per ton in 2011. This surge was primarily driven by a combination of supply constraints and strong demand from the fertilizers and chemicals industries.

Following the 2011 peak, the price of Sulphur started to decline, reaching a low of $150 per ton in 2016. The decline was attributed to increased production capacity and a slowdown in demand from the fertilizers and chemicals industries.

Since 2016, the price of Sulphur has been on an upward trend, reaching $250 per ton in 2020. This increase can be attributed to a combination of supply constraints, geopolitical tensions, and rising production costs.

Future Projections

Looking ahead, several factors are expected to influence the price of Sulphur in the coming years. Here are some key considerations:

-

Supply Constraints: As the global Sulphur market continues to face supply constraints, prices are likely to remain elevated.

-

Geopolitical Tensions: Geopolitical tensions and trade disputes can disrupt supply chains and impact prices.

-

Production Costs: Rising production costs, particularly in the extraction and refining sectors, may contribute to higher prices.

-

Demand Growth: The growing demand for Sulphur in the fertilizers and chemicals industries is expected to support prices.

Based on these factors, industry experts predict that the price of Sulphur will continue to rise in the short to medium term, potentially reaching $300 per ton by 2025.

Conclusion

Understanding the Sulphur price chart per ton is essential for businesses and investors in the Sulphur market. By analyzing historical trends, market dynamics, and future projections, one can gain valuable insights into the factors influencing Sulphur prices. As the global market for Sulphur continues to evolve, staying informed about the latest developments is crucial for making informed decisions.