Lme Pb Prices Per Ton: A Comprehensive Overview

When it comes to lead (Pb) prices, the London Metal Exchange (LME) is a key reference point for global markets. The LME Pb prices per ton are not just a reflection of the current market conditions but also a barometer of the industry’s health. In this article, we delve into the various aspects that influence LME Pb prices per ton, providing you with a detailed and multi-dimensional perspective.

Market Dynamics

The LME Pb prices per ton are influenced by a variety of factors, including supply and demand dynamics, global economic conditions, and regulatory changes. Understanding these factors is crucial for anyone looking to stay informed about the market.

Supply and demand dynamics are perhaps the most fundamental factors affecting LME Pb prices per ton. The global supply of lead is primarily sourced from mines, smelters, and scrap processors. On the demand side, lead is used in various applications, including batteries, ammunition, and construction materials. Any changes in the supply or demand for lead can significantly impact prices.

Global Economic Conditions

Global economic conditions play a significant role in determining LME Pb prices per ton. Economic growth, particularly in major lead-consuming countries like China and the United States, can lead to increased demand for lead, driving up prices. Conversely, economic downturns can lead to reduced demand and lower prices.

Moreover, fluctuations in the value of the US dollar, which is the currency in which LME Pb prices are quoted, can also impact prices. A weaker dollar makes lead more expensive in other currencies, potentially increasing demand and pushing prices higher.

Regulatory Changes

Regulatory changes can also have a significant impact on LME Pb prices per ton. For instance, stricter environmental regulations in lead-producing countries can lead to increased production costs and reduced supply, which can drive up prices. Similarly, changes in import/export policies can affect the availability of lead in certain markets, further influencing prices.

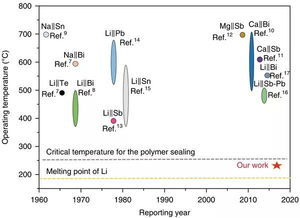

Historical Price Trends

Understanding historical price trends can provide valuable insights into the future direction of LME Pb prices per ton. Over the past few years, the price of lead has experienced periods of volatility, influenced by various factors mentioned earlier.

For example, in 2016, the LME Pb price per ton reached a high of around $2,000 due to supply concerns and strong demand. However, by 2018, the price had dropped significantly, reflecting a more balanced market. As of early 2021, the price was hovering around $1,800 per ton, indicating a stable market environment.

Market Forecast

Forecasting the future direction of LME Pb prices per ton is challenging, given the numerous factors that can influence the market. However, some key trends and factors to consider include:

-

Increased demand for lead-acid batteries in emerging markets

-

Environmental regulations and their impact on lead production and recycling

-

Global economic conditions and their influence on lead consumption

-

Supply disruptions due to geopolitical tensions or natural disasters

Based on these factors, some market analysts predict that LME Pb prices per ton may remain relatively stable in the short to medium term, with potential for slight increases in the long term.

Conclusion

Understanding the LME Pb prices per ton requires a comprehensive understanding of market dynamics, global economic conditions, regulatory changes, historical price trends, and future market forecasts. By staying informed about these factors, you can better navigate the lead market and make informed decisions.

| Year | LME Pb Price per Ton (USD) |

|---|---|

| 2016 | $2,000 |

| 2017 | $1,800 |

| 2018 | $1,500 |

| 2019 | $1,700 |

| 2020 | $1,600 |

| 2021 | $1,800 |