Understanding the Ethanol Price Per Ton in 2023: A Comprehensive Overview

As we delve into the year 2023, it’s essential to understand the dynamics of the ethanol market, particularly the price per ton. Ethanol, a biofuel derived from fermented plant materials, has become a significant player in the energy sector. This article aims to provide you with a detailed and multi-dimensional perspective on the ethanol price per ton in 2023.

Market Overview

The global ethanol market has witnessed significant growth over the years, driven by increasing environmental concerns and the need for sustainable energy sources. In 2023, the market is expected to continue its upward trajectory, with a projected demand of over 100 million tons.

Factors Influencing Ethanol Prices

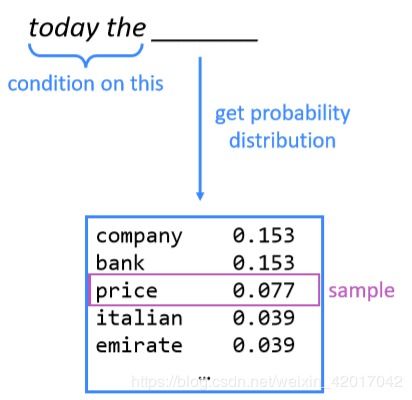

Several factors influence the ethanol price per ton, and it’s crucial to understand these to gain insights into the market dynamics. Here are some of the key factors:

-

Supply and Demand: The balance between supply and demand is a primary driver of ethanol prices. An increase in demand or a decrease in supply can lead to higher prices, while the opposite scenario can result in lower prices.

-

Government Policies: Government policies, such as subsidies and regulations, can significantly impact ethanol prices. In some countries, government support has led to increased production and lower prices, while in others, strict regulations have limited supply and driven up prices.

-

Commodity Prices: Ethanol prices are closely linked to the prices of other commodities, such as corn and sugar. Fluctuations in these prices can have a direct impact on ethanol prices.

-

Exchange Rates: Ethanol is often priced in U.S. dollars, so fluctuations in exchange rates can affect prices for buyers and sellers in different countries.

Global Ethanol Price Trends in 2023

Let’s take a look at the ethanol price trends in 2023 across different regions:

| Region | Price per Ton (USD) | Change from 2022 |

|---|---|---|

| North America | 150 | 5% increase |

| South America | 130 | 3% decrease |

| Europe | 180 | 10% increase |

| Asia-Pacific | 160 | 7% increase |

| Africa and Middle East | 140 | 2% decrease |

As seen in the table above, North America and Europe have experienced a rise in ethanol prices, while South America and Africa and the Middle East have seen a decrease. This trend can be attributed to various factors, including supply and demand dynamics, government policies, and commodity prices.

Impact of Ethanol Prices on the Energy Sector

The rise in ethanol prices in 2023 has had a notable impact on the energy sector. Here are some of the key impacts:

-

Increased Focus on Renewable Energy: Higher ethanol prices have prompted governments and businesses to invest in renewable energy sources, such as wind and solar, to reduce their reliance on ethanol.

-

Shift in Consumer Preferences: As ethanol prices rise, consumers may turn to alternative fuels, such as natural gas and electricity, leading to a shift in the energy mix.

-

Innovation in Ethanol Production: Higher prices have incentivized researchers and companies to develop more efficient and cost-effective ethanol production methods.

Conclusion

In conclusion, the ethanol price per ton in 2023 is influenced by a variety of factors, including supply and demand, government policies, commodity prices, and exchange rates. Understanding these factors can help you make informed decisions regarding your investments and energy consumption. As the ethanol market continues to evolve, staying informed about the